Once upon a time, accepting payments as a self-employed professional was a process that required research, patience, and faith.

You could make things easier for your clients or customers by accepting credit cards, but you had to deal directly with the credit card company and pay the exorbitant merchant fees they impose.

Sure, you could do everything by check, but then you had to wait on the mail and you had little control over when the check would be cut and the invoice paid.

Wire transfers had (and still have) such high fees that it’s worth doing pretty much anything to avoid them, meaning international clients were either out of the question or necessitated budgeting an extra $20-50 into every payment.

If your client or customers were local, you could accept cash, but then you need to meet them in person and visit the bank regularly and fill out paper deposit slips.

While we’re all incredibly thankful that the internet and other technology advances make receiving money easier, that ease doesn’t come without a price.

The PayPal Fee Landscape

Today, one of the most widely accepted ways of paying people and being paid is PayPal. For freelancers, it’s great because you can essentially send a simple digital invoice to clients in the form of a payment request—which you can even set to recur automatically every month, cutting down on your invoicing time—and you can pay others with a credit card, helping your cash flow.

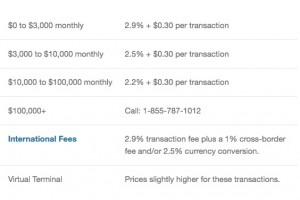

When you look at the PayPal fee equation, it seems very reasonable:

Three or four percent? Thirty cents? That’s nothing! So it’s easy to start using it for everything.

You may even set up a merchant account if you do a high volume of online payments, because it offers lower rates!

But when tax time comes, and you have to sort out how much money you actually received versus what you paid in fees, a shocking realization often occurs…

You are giving PayPal thousands of dollars of your hard earned money every year.

If you’re okay with that, that’s fine.

But let me tell you right now: you do not have to spend that much on payment acceptance fees.

How the Fees Add Up

For small amounts, say $20 for an e-book or $100 for a coaching session, the fee that comes out may seem annoying, but inconsequential.

Unless you accept very large payments, you might not even notice the pinch.

But send a larger invoice, say $1000, and PayPal’s piece of the pie becomes more evident.

Income – PayPal’s Percentage Cut

$100 – $4

$1,000 – $40

$10,000 – $400

$100,000 – $4000

And don’t forget the $0.30 per transaction, which adds up on small transaction-based businesses.

Number of Transactions – PayPal’s Cut

1 – $0.30

10 – $3

100 – $30

1000 – $300

If you’re making $50,000 per year coaching at $100 per session and accepting all your payments through PayPal, you’re paying $2000 in percentage payments and $150 in transaction fees.

While I’m focusing on PayPal here, this is true for several other third-party payment processing methods. After all, they have to pay their own bills somehow!

If you sell e-books, you’ll notice this with E-junkie, likewise with Eventbrite for events and Etsy for crafts. It is, literally the cost of doing business.

But, depending on what you sell, there can be another way.

The Two Best Ways to Stop Giving Away $$

It’s an oldie but goodie: the best way to stop giving third-party processors a chunk of your pay is to go old-fashioned. Analog, if you will. But with a digital twist.

As fewer and fewer people rely on checks to pay their bills and thus don’t have up to date checkbooks on hand for the times they really need to pay that way, banks have started going green and saving everyone money by offering check cutting and sending services—typically completely free!

If you have a client-based business, see if they have that option for their bank. They can typically even set up recurring payments, saving them from remembering to pay you and you from the time spent invoicing.

Or if you’re comfortable, you can also have them do a transfer directly to your bank account. They need your account number and bank routing number, which is the same information printed on checks, so it is not a significant identity theft risk like some other personal data.

When you work with a lot of people or transactions, this method isn’t feasible and you may really want to stick with PayPal. But there is still a way to skip the fees. Mostly at least.

With Freshbooks, you’ll only be charged fifty cents per transaction, no matter the amount.

Yes, Freshbooks itself has a cost, but you’re not paying for payment processing, you’re paying for accounting software (with great invoicing features) that provides additional value for your business.

Do your budget a favor and put an audit of your payment processing fees on the to do list.